Understanding the Importance of Accurate Check Writing

Writing a check may seem outdated in our digital age, but accurately completing this financial instrument remains crucial. Incorrectly written checks can lead to payment delays, returned checks, and even fraudulent activity. This guide provides clear, step-by-step instructions for writing a check for $2225, emphasizing accuracy and security best practices to protect your finances. Did you know that a simple oversight can delay your payment or even invite fraudulent actions? Let's learn how to avoid these issues.

How to Write a Check for $2225: A Step-by-Step Guide

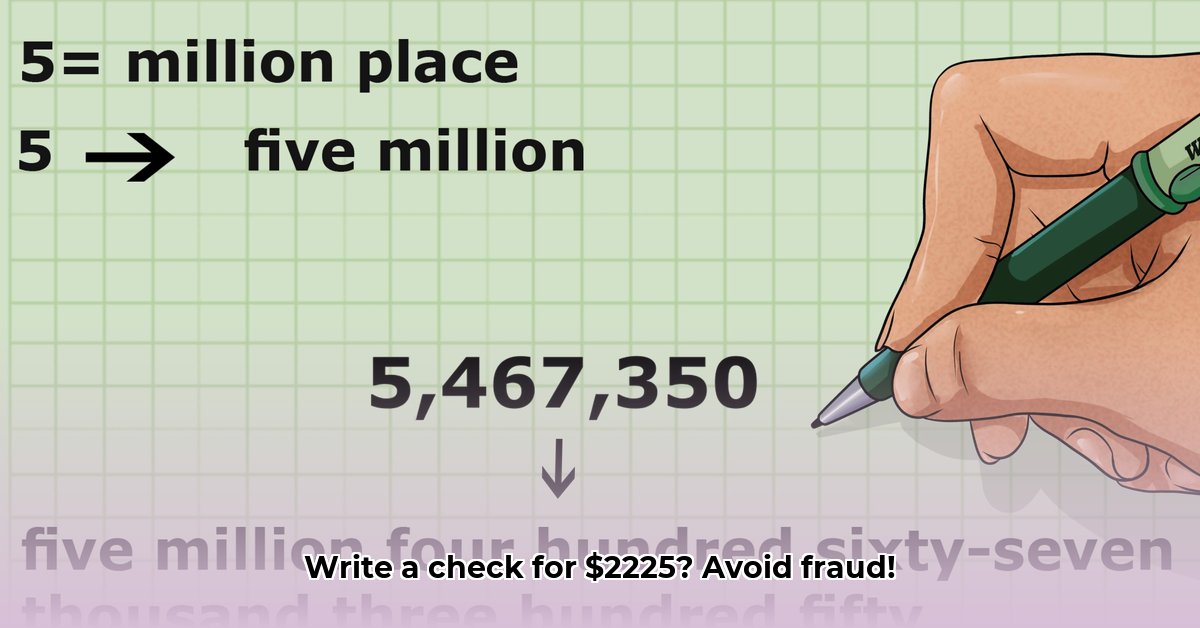

Writing a check for $2225 involves two key steps: accurately representing the amount numerically and spelling it out in words. This dual representation acts as a safeguard against alteration and fraud.

Enter the Numerical Amount: In the designated box on the check, write the amount as "2225.00". The decimal point and trailing zeros are essential; they represent cents, even if the amount is a whole number of dollars. This ensures accurate machine processing by banking systems.

Write Out the Amount in Words: Below the numerical amount box, carefully write out the amount in words: "Two Thousand Two Hundred Twenty-Five and 00/100". The inclusion of "and 00/100" is critical, even if the amount has no cents. This written representation provides an additional layer of security against fraud.

Verify Numerical and Written Amounts: Carefully compare the numerical and written amounts to ensure they match precisely. Any discrepancy can result in payment rejection. This is one of the most crucial steps in preventing payment problems.

Use Legible Handwriting: Write clearly using a pen with dark ink. Avoid cursive; print neatly to ensure easy readability for both manual and machine processing. Illegible handwriting is a major cause of processing errors.

Draw a Security Line: Draw a line from the end of the written amount, extending to the right edge of the check. This prevents anyone from altering the amount after the fact. A simple line reduces risks significantly.

Common Mistakes and How to Avoid Them

Several common errors can lead to check processing problems. Addressing these proactively safeguards your funds and prevents financial inconveniences.

Discrepancies Between Numerical and Written Amounts: This is the most frequent error. Always double-check that the numbers and words exactly match.

Illegible Handwriting: Messy handwriting makes checks difficult to read and can lead to delays or rejection. Print clearly and legibly.

Omission of Cents: Never omit ".00" after the numerical amount, even if the amount is whole dollars.

Forgetting "and": Always include "and" before the cents in the written amount.

Absence of a Security Line: Drawing the line after the written amount is an essential security measure, preventing fraudulent modifications.

Enhancing Check Security Best Practices

Additional security precautions help to minimize the risk of fraud and ensure the safe and timely processing of your payment.

Use Permanent Ink: Utilize a pen with permanent, non-erasable ink.

Maintain a Secure Checkbook: Store your checkbook in a safe place to prevent theft or loss. Protect your financial information.

Regularly Reconcile Checkbook: Reconcile your checkbook with your bank statement to easily identify and correct potential discrepancies promptly. This is a vital step in financial management.

Key Takeaways For Writing Checks Successfully

Accuracy is Paramount: Precisely matching numerical and written amounts is crucial for efficient payment processing.

Legibility Prevents Errors: Clear handwriting minimizes misinterpretations and ensures smooth transactions.

Proactive Security Measures: Implementing security practices like drawing a security line significantly reduces the risk of fraud.

This guide, by outlining the steps for writing a check for $2225, illustrates the process of accurately and safely handling larger monetary transactions via check. Remember, accuracy and careful attention to detail are essential in handling financial documents. By following these guidelines, you safeguard your money and ensure smooth and secure transactions.